Question: “How to structure a real estate wholesale deal?”

With “how real estate wholesale works”, you find deeply discounted properties by simply marketing to people that are in distressed situations.

A distressed property is a property that needs a lot of repairs. And sometimes, the ownership is distressed.

The ownership can’t afford to hold onto the property, so they need to get rid of the property.

There are many other possible reasons beyond just the house. Some people just sometimes bite much more than they can chew.

There are marketing skills that you have to put in place to find these kinds of homeowners and properties.

Now let’s say you’ve successfully found a piece of property and you lock it up under contract.

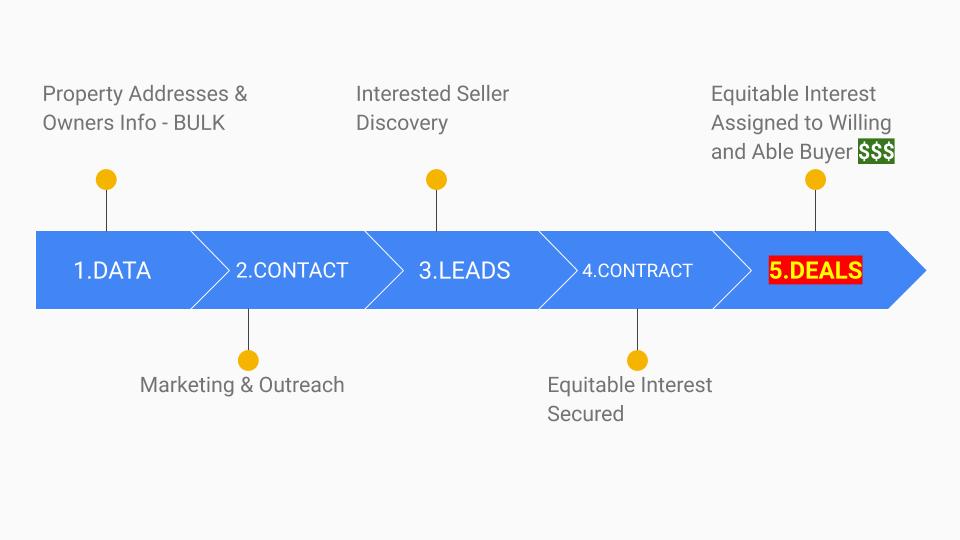

There are 5 stages in this process.

The 5 stages in this process is what you see below:

There’s Data, Contact, Leads.

You generated the lead, meaning somebody said

“yes, I’m open to selling you this piece of property”,

…and then you negotiated a good deal, and then it’s now under Contract.

So you lock the property up under contract, and then it’s time to pass that piece of paper,

…that contract onto somebody else who will actually execute the deal.

That person that will execute the deal has the cash and are probably going to fix and repair the property.

Potentially they may also choose to hold onto the property and just be a landlord. That’s their business.

You just collect your $10,000 or $25,000 depending on how big or how sweet the deal is and you just keep it moving.

So How to structure a real estate wholesale deal?

PREVIOUS POST: HOW MUCH Do Real Estate Wholesalers MAKE A YEAR?

There are a couple of ways to structure it.

There’s something called assignment which means it’s the same contract that you assign over to the end buyer.

That’s one

Another way to structure is something called the double escrow or double closing

…or some people call it back to back closing.

What that means is essentially, you purchase the property and then you re-sell the property right away on the same closing table to another person.

That’s absolutely legal.

Now there are certain financing structures that won’t allow that,

…because people can take advantage of that in mass and take advantage of people.

So you will find that Mortgage companies will not allow this kind of situation.

If there’s a short sale that was agreed upon where the bank agreed to sell your property for $120,000,

The bank, of course, does not want you to be selling the property immediately for a profit of $15,000.

That’s the monies that’s supposed to go to them because the short sale means they already took a loss.

They want all the money that’s gonna come from the closing… period.

So usually they will not allow that.

Another situation where they won’t allow just assignment deals or even double closing is a situation of REO.

They’re essentially Real Estate Owned properties, they are real estate owned by banks.

For the same reasons, the bank doesn’t want you to profit off their loss after they’ve foreclosed; they just want all the money they get from it.

Because of that, they will restrict the title transfer of the property and they don’t want you flipping the properties so quick.

They don’t mind you making a profit from a property…

But not on the same table

TRENDING: Smart Real Estate Wholesaling

So double closing, for the most part is restricted to cash deals.

Because the people that’s buying the property don’t care as long as the property has enough money and equity in it for them to make money,

…they don’t care how you structure.

It’s all cash and there’s more than enough people doing cash deals.

Basically the way it works with assignment deals is that,

If your profit is gonna be more than $15,000, the end-buyer will find out and most of them don’t want you to make that kind of money.

So if you know that your profit is gonna be potentially more (like my highest I’ve made up to date is $82,000 from one deal)…

It is best that you go with the double closing or double escrow structure.

That way you facilitate two different transactions, and incur costs of two different transactions.

But that’s OK.

The money is in the deal and you can simply sell the property once you acquire the property at the same table.

Now, back in the days you were allowed to use the same cash coming from the end buyer to do both transactions,

…but these days, there are restrictions to that but there is also a very easy solution to that they’re called transactional funding.

You can literally Google “transactional funding” and they come up all over the place.

Basically, they will give you money to do a deal, and they will charge you one or two points.

…Meaning 1% or 2% of how much money they give you, and they will take that money back the same day.

So it’s like… they give you $100,000, they’re gonna get $102,000 back from you if they are charging 2%.

It’s worth it for them, it’s just basically flipping the money really quickly and that keeps the deal clean.

That way…

You use a separate cash for the first deal and then you pay them their money back

And then you can sell the property right away to another person as you keep your profit.

Case Study

Let’s say you purchase a property for $80,000 and somebody is now willing to pick up the property from you for $120,000.

That’s a $40,000 spread, and that’s much more than $10,000-15,000.

Hard money lenders don’t want to do deals that have profit spreads more than $15,000 going to a wholesaler…

… in their mind, for doing nothing.

Of course you did something. You marketed to find the deals right?

You spend a lot of time marketing to find these deals but again, don’t worry about the politics of it.

Just keep the deal separate.

You’re purchasing the property and you’re selling it to somebody else.

You are allowed to us transactional funding to fund your deals and it literally cost you nothing .

Then the end buyer will be buying the property with their own cash, or hard money lending.

With all cash deals, basically anything goes as long as the attorney and the closing agent are okay with the structure.

You just let them worry about the legalities.

You find deals.

Now, how to structure a real estate wholesale deal.

HAVE YOU SEEN THIS: More Video on our YouTube Channel

This is a topic usually beyond the scope of what I teach here.

I teach you how to market, how to find these deals.

That’s how you get paid. You get paid from learning how to find deals.

You don’t get paid for learning how to structure deals. You get paid for creating results. How do you create results?

You find good deals leveraging mass marketing.

Create a pipeline of leads for your business every day, and you could do everything else wrong,

…you get paid.

You get paid because there’s more than enough people that will help you do the deal because you learn how to find a deal.

But if you are just busy spending your time on LLC creation, contracts and stuff like that, you’re probably gonna fail anyway.

Because again, you’re missing the point. Money comes from only one place, from PEOPLE.

Not even from properties,

…from people that control properties and those are the people you need to be spending your time finding.