Discover the power of Maximum Allowed Offer (MAO) in real estate wholesale and learn how to calculate it effectively.

What is MAO in Real Estate?

This comprehensive guide will break down the MAO formula, explain its significance in the industry, and explore its flexibility based on city density.

Whether you’re a seasoned investor or a beginner in real estate, understanding MAO is crucial for optimizing your profit potential.

What You Will Learn…

- Demystifying MAO: Learn what MAO stands for and why it is essential in real estate wholesaling.

- Calculating MAO: Explore the straightforward formula for determining the Maximum Allowed Offer and its connection to the After Repair Value (ARV).

- Understanding ARV: Discover how the ARV is calculated using the weighted average of comparable properties within a 1-mile radius.

- Flexibility of the 65% Rule: Uncover how the MAO formula varies based on city density and turnover rates.

- Higher MAO in Busy Cities: Find out why a bustling market may allow for a higher MAO, potentially reaching up to 85%.

- Lower MAO in Less Busy Cities: Learn why conservative estimates with a lower MAO of around 55% are prudent in slower markets.

- Adapting to Market Conditions: Understand the importance of conducting thorough market research to determine the ideal MAO for each property.

- Maximizing Profit Potential: Discover how leveraging the MAO formula can help optimize your profit margins in real estate wholesale deals.

Understanding the MAO Formula and its Significance in Real Estate Wholesaling

Real estate wholesaling offers an excellent opportunity for investors to generate profits without the need for extensive renovations or long-term ownership.

As you delve into the world of wholesaling, one term that you’ll encounter frequently is MAO, short for Maximum Allowed Offer.

Understanding the MAO formula and its implications can be the key to maximizing your profit potential in this dynamic industry.

What is MAO, and how is it calculated?

MAO represents the maximum amount you can offer for a property, ensuring that you secure a profitable wholesale deal.

The formula is simple: it involves multiplying the After Repair Value (ARV) by 65%.

The ARV is determined by taking the weighted average of the fair market value of comparable properties, also known as comps, within a 1-mile radius of the subject property.

The flexibility of the 65% rule is where things get interesting.

The percentage can vary based on the density and turnover of the city you’re operating in.

In high-density cities with a bustling real estate market, the MAO rule can be pushed to as high as 85%.

This means you can offer a more generous amount and still ensure a profitable transaction due to the larger pool of potential buyers and higher demand for properties.

Conversely, in less busy cities with lower population density, it’s advisable to be more conservative.

The MAO rule may drop to as low as 55% in such markets to safeguard your profit margins.

To determine the ideal MAO for a property, comprehensive market research is crucial.

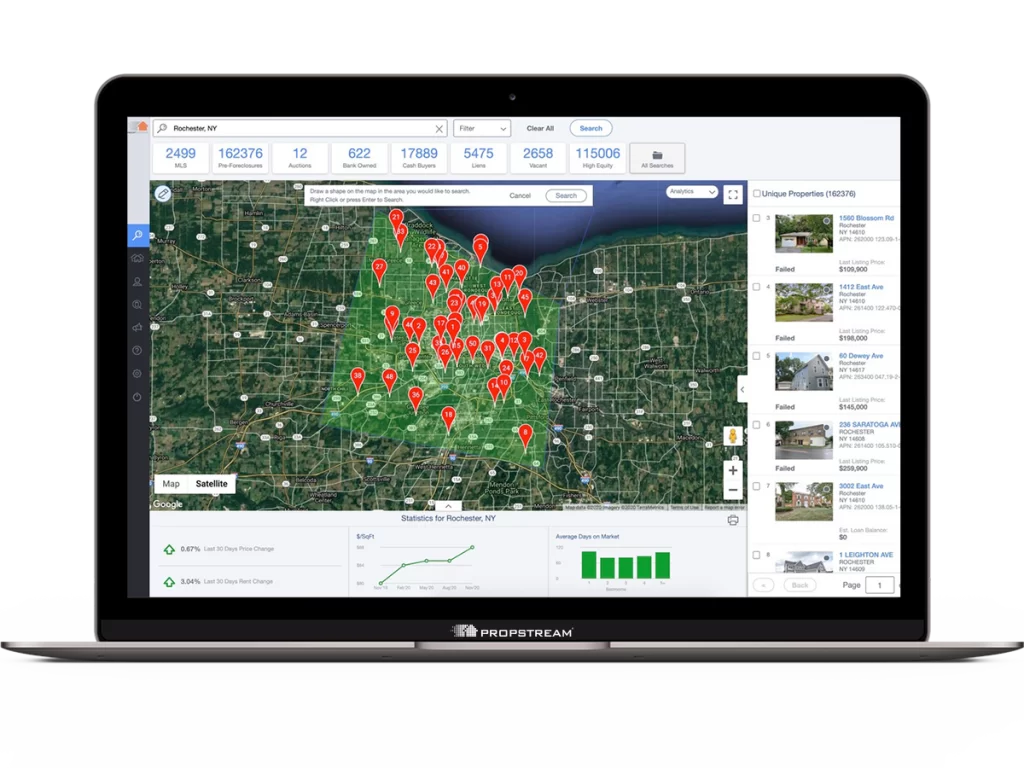

Study recent sales data, track trends, and evaluate the supply and demand dynamics in your target area. Click Here & Check out this tool for free to help with that.

By gaining a deep understanding of the local market, you’ll be better equipped to adjust your MAO accordingly, optimizing your chances of success.

By leveraging the MAO formula effectively, you can strike a balance between offering competitive prices to sellers while ensuring a profitable wholesale deal.

Remember that MAO is not the sole determinant of success in real estate wholesaling.

Negotiation skills, property condition, repair costs, and other factors also come into play.

However, MAO provides a solid foundation for making informed investment decisions.

Now that you have a clearer understanding of MAO and its significance in real estate wholesaling, you’re well-equipped to navigate the world of wholesale deals with confidence and maximize your profit potential.

Demystifying MAO: Learn what MAO stands for and why it is essential in real estate wholesaling.

MAO, which stands for Maximum Allowed Offer, is a crucial concept in the realm of real estate wholesaling.

It represents the maximum amount you can offer for a property while still ensuring a profitable wholesale deal.

By understanding MAO, you can establish a baseline offer that takes into account factors such as repairs, holding costs, and desired profit margins.

This knowledge allows you to approach negotiations with confidence and make informed investment decisions.

Calculating MAO: Explore the straightforward formula for determining the Maximum Allowed Offer and its connection to the After Repair Value (ARV).

The formula for calculating MAO is relatively straightforward.

It is derived by multiplying the After Repair Value (ARV) of the property by a predetermined percentage.

The formula is as follows:

MAO = (ARV x 65%) – Repair Estimate

This formula ensures that you are offering a percentage of the property’s estimated value after repairs have been made.

The 0.65 multiplier corresponds to the common practice of setting MAO at 65% of the ARV after being adjusted for repair estimate.

Understanding ARV: Discover how the ARV is calculated using the weighted average of comparable properties within a 1-mile radius.

To accurately determine the ARV, you need to consider the fair market value of comparable properties, also known as comps, within a 1-mile radius of the subject property.

These comps should be properties that are similar in size, condition, and location. Here is a free tool for analyzing comps.

By analyzing recent sales data and considering the characteristics of these comparable properties, you can arrive at a reasonable estimate of the ARV.

The ARV formula does not involve any specific percentage, as it serves as a baseline value for determining the potential worth of the property after repairs have been completed.

It is important to note that the accuracy of the ARV estimation greatly impacts the reliability of the MAO calculation.

Flexibility of the 65% Rule: Uncover how the MAO formula varies based on city density and turnover rates.

While the standard practice is to set the MAO at 65% of the ARV, it is important to recognize that the 65% rule is not fixed.

Its flexibility depends on the density and turnover of the city where the property is located.

In high-density cities with a fast-paced real estate market, the MAO rule can be adjusted upward to as much as 85%.

The increased demand and larger pool of potential buyers justify offering a higher MAO, allowing for faster turnover and increased profit potential.

On the other hand, in less busy cities with lower population density and slower market conditions, it is prudent to be more conservative.

In these markets, the MAO rule may be adjusted downward to around 55%.

By offering a lower MAO, you can mitigate risks and ensure sufficient profit margins despite the slower market activity.

Adapting to Market Conditions: Understand the importance of conducting thorough market research to determine the ideal MAO for each property.

To effectively leverage the MAO formula and maximize profit potential in real estate wholesale deals, conducting thorough market research is paramount.

Analyze recent sales data, track market trends, and evaluate the supply and demand dynamics specific to the area you’re operating in.

By gaining a comprehensive understanding of the local real estate market, you can adjust your MAO calculations accordingly for each property.

Market conditions play a significant role in determining the ideal MAO.

By adapting to these conditions and utilizing accurate data, you can make informed decisions that align with the specific demands of the market.

This adaptability allows you to optimize your profit margins and increase the likelihood of successful wholesale deals.

Maximizing Profit Potential: Discover how leveraging the MAO formula can help optimize your profit margins in real estate wholesale deals.

The MAO formula serves as a valuable tool for real estate investors and wholesalers seeking to maximize their profit potential.

By accurately calculating the Maximum Allowed Offer based on the ARV, and considering the flexibility of the 65% rule based on city density, you can optimize your profit margins in wholesale deals.

Leveraging the MAO formula enables you to approach negotiations with sellers confidently.

It ensures that your offer is both competitive and profitable, taking into account repair costs, holding costs, and desired profit margins.

By adapting your MAO to market conditions and conducting thorough research, you can enhance your chances of success and generate substantial profits in the world of real estate wholesaling.

Frequently Asked Questions (F.A.Q)

The MAO formula stands for Maximum Allowed Offer and is calculated by multiplying the After Repair Value (ARV) by 65% and adjusting the product with the repair estimate.

MAO stands for Maximum Allowed Offer and represents the maximum amount you can offer for a property while ensuring a profitable wholesale deal.

In wholesaling, MAO refers to the Maximum Allowed Offer, which determines the highest price you can offer for a property to secure a profitable transaction.

The ARV is calculated by taking the weighted average of the fair market value of comparable properties (comps) within a 1-mile radius of the subject property.